Personal Finance UK is a crucial aspect of living in the United Kingdom, influencing everything from daily spending to long-term financial goals. Understanding the principles of personal finance management, navigating the unique UK financial landscape, and making informed decisions about budgeting, saving, debt, investing, and insurance can empower individuals to build a secure and prosperous future.

This guide provides a comprehensive overview of personal finance in the UK, covering essential topics such as budgeting, saving, debt management, investing, tax planning, insurance, and digital tools. We aim to equip you with the knowledge and practical strategies needed to effectively manage your finances, achieve your financial goals, and navigate the complexities of the UK financial system.

Understanding Personal Finance in the UK: Personal Finance Uk

Taking control of your finances is essential in the UK, and understanding the principles of personal finance management can empower you to make informed decisions about your money. This section will explore the key principles of personal finance management in the UK, delve into the impact of UK-specific financial regulations and legislation on personal finance, and provide a comprehensive overview of the UK financial landscape, including major financial institutions and services.

Key Principles of Personal Finance Management in the UK

Effective personal finance management involves understanding and implementing a set of core principles. These principles guide individuals in making sound financial decisions, ensuring long-term financial stability and well-being.

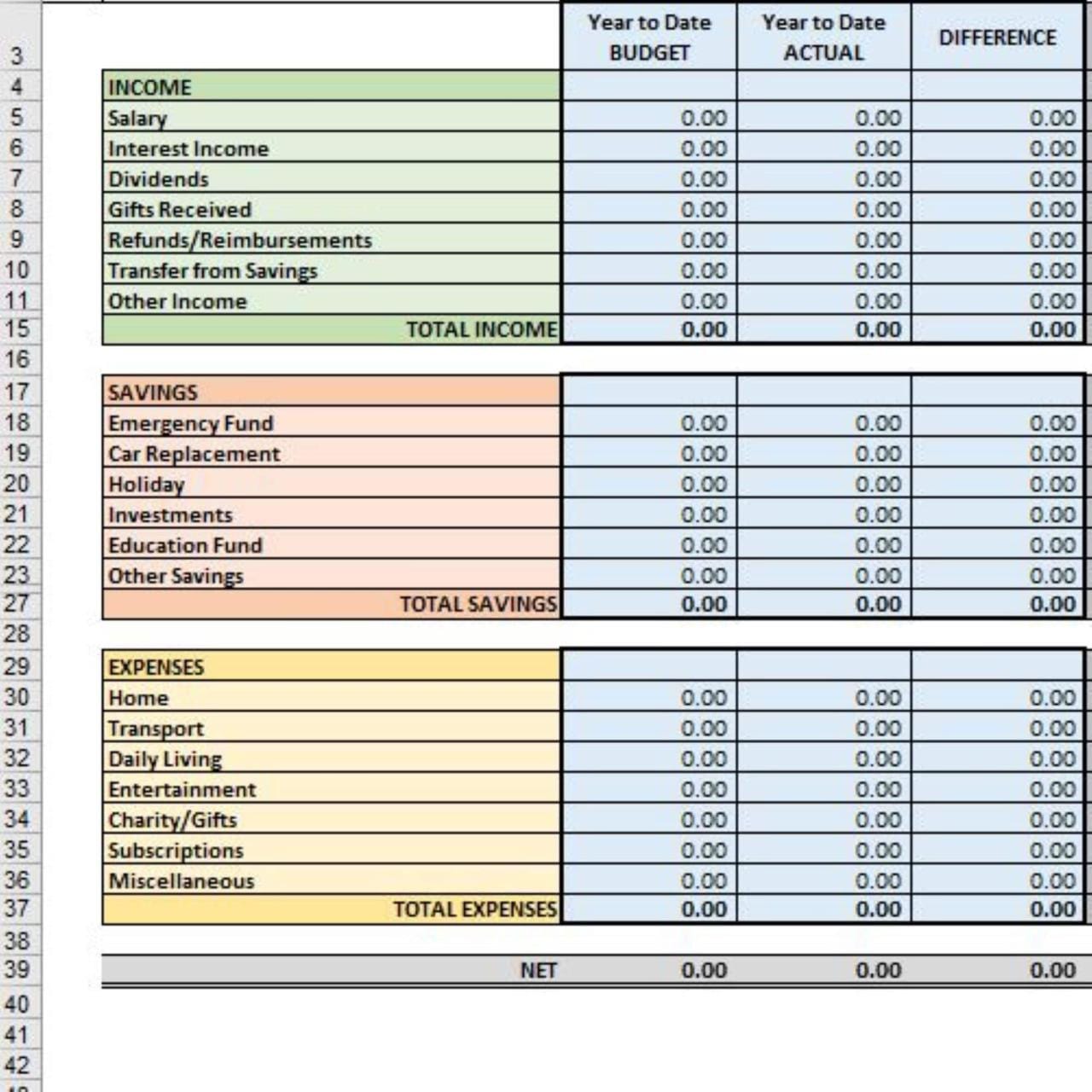

- Budgeting: Creating a budget is fundamental to managing your finances effectively. A budget helps you track your income and expenses, identify areas where you can save money, and plan for future financial goals.

- Saving: Setting aside a portion of your income for savings is crucial for financial security. Savings provide a safety net for unexpected expenses, help you reach financial goals, and offer opportunities for investment.

- Debt Management: Managing debt responsibly is essential for maintaining financial stability. This involves understanding the different types of debt, prioritizing repayment strategies, and minimizing the accumulation of unnecessary debt.

- Investing: Investing allows you to grow your wealth over time. Understanding different investment options, assessing risk tolerance, and developing a diversified investment portfolio are key aspects of successful investing.

- Financial Planning: Developing a comprehensive financial plan involves setting financial goals, creating a roadmap to achieve those goals, and regularly reviewing and adjusting your plan based on changing circumstances.

Impact of UK Financial Regulations and Legislation

The UK has a robust regulatory framework for its financial sector, which aims to protect consumers and ensure the stability of the financial system. These regulations and legislation directly impact personal finance in various ways.

- Consumer Protection: Regulations like the Financial Conduct Authority (FCA) guidelines protect consumers from unfair practices and ensure they receive clear and transparent financial information. These regulations cover areas such as lending, mortgages, and investments, promoting responsible lending practices and protecting borrowers from predatory lending.

- Financial Stability: Regulations aimed at financial stability, such as the Bank of England’s monetary policy and prudential regulations, help to maintain a healthy and resilient financial system. These regulations influence interest rates, lending practices, and the overall stability of the UK economy, impacting the availability of credit and the cost of borrowing for individuals.

- Taxation: UK tax laws and regulations significantly impact personal finance. Understanding tax implications for income, savings, investments, and property ownership is crucial for optimizing financial decisions and minimizing tax liabilities.

Overview of the UK Financial Landscape

The UK boasts a sophisticated and diverse financial landscape, offering a wide range of financial institutions and services to individuals and businesses.

- Banks: High street banks play a crucial role in the UK financial system, offering a variety of services, including current and savings accounts, mortgages, loans, and investment products. Major banks in the UK include Barclays, HSBC, Lloyds Banking Group, and NatWest.

- Building Societies: Building societies are mutual financial institutions owned by their members. They offer similar services to banks, often focusing on mortgages and savings products. Notable building societies include Nationwide Building Society and Coventry Building Society.

- Credit Unions: Credit unions are not-for-profit financial cooperatives owned and controlled by their members. They provide a range of financial services, including savings accounts, loans, and insurance, often with a focus on community development.

- Investment Firms: Investment firms offer a wide range of investment products and services, including stocks, bonds, mutual funds, and investment advice. Major investment firms in the UK include Fidelity, Schroders, and BlackRock.

- Insurance Companies: Insurance companies provide financial protection against various risks, including life insurance, health insurance, and property insurance. Leading insurance companies in the UK include Aviva, Prudential, and Legal & General.

- Financial Regulators: The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are key regulators in the UK financial sector. They oversee financial institutions, protect consumers, and ensure the stability of the financial system.

Budgeting and Saving

Taking control of your finances in the UK starts with creating a budget and establishing a saving plan. A well-structured budget helps you understand your income and expenses, allowing you to make informed financial decisions and achieve your financial goals.

Creating a Personal Budget

Creating a personal budget is the first step towards managing your finances effectively. Here are some practical tips:

- Track Your Income and Expenses: Start by recording all your income sources, including your salary, benefits, and any other regular income. Then, meticulously track all your expenses, categorizing them into essential needs like housing, food, and transportation, and discretionary expenses like entertainment, dining out, and shopping.

- Use Budgeting Tools: Utilize budgeting apps, spreadsheets, or online tools to streamline the process. These tools can automatically categorize transactions, track spending patterns, and provide insights into your financial behavior.

- Set Realistic Financial Goals: Define your financial objectives, whether it’s saving for a house, paying off debt, or investing for retirement. These goals will guide your budgeting decisions and motivate you to stick to your plan.

- Allocate Funds to Savings: Once you have a clear picture of your income and expenses, allocate a specific portion of your income to savings. This should be a priority, even if it’s a small amount at first.

- Review and Adjust Regularly: Regularly review your budget to ensure it aligns with your changing circumstances and financial goals. Make adjustments as needed to maintain balance and achieve your objectives.

Saving Strategies in the UK

Saving is essential for financial security and achieving long-term goals. The UK offers various saving options:

- ISAs (Individual Savings Accounts): ISAs are tax-efficient savings accounts that allow you to save or invest without paying tax on your earnings. There are different types of ISAs, including Cash ISAs, Stocks and Shares ISAs, and Lifetime ISAs, each with its own benefits and features.

- Pensions: Pensions are long-term savings plans designed to provide income during retirement. In the UK, employers are required to contribute to their employees’ pensions, and individuals can also make personal contributions. Pensions offer tax relief on contributions and the potential for tax-free income during retirement.

- Other Investment Accounts: Besides ISAs and pensions, other investment accounts are available, such as unit trusts, investment trusts, and self-invested personal pensions (SIPPs). These accounts offer the potential for higher returns but also carry higher risk.

Emergency Funds

An emergency fund is a crucial element of financial security. It provides a safety net to cover unexpected expenses, such as medical bills, car repairs, or job loss.

- Importance of an Emergency Fund: An emergency fund acts as a buffer to prevent financial hardship during unexpected events. It helps you avoid accumulating debt or dipping into your savings for unforeseen circumstances.

- Building an Emergency Fund: Start by setting a goal for your emergency fund, typically 3-6 months of essential living expenses. Allocate a specific amount from your budget each month to contribute to the fund. Consider using a high-interest savings account to maximize returns.

- Tips for Building an Emergency Fund:

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund to ensure consistent contributions.

- Reduce Unnecessary Expenses: Identify areas where you can cut back on spending and allocate those savings to your emergency fund.

- Side Hustles: Consider taking on a side hustle to generate extra income and accelerate your emergency fund growth.

Tax and Financial Planning

Understanding the UK tax system and its implications is crucial for effective personal finance management. It allows individuals to make informed decisions regarding income, investments, and spending, ultimately maximizing their financial well-being.

Income Tax

Income tax is a significant aspect of the UK tax system. It is levied on individuals’ earnings from various sources, including employment, self-employment, and investments.

- The UK uses a progressive tax system, meaning higher earners pay a larger proportion of their income in tax.

- The tax year runs from April 6th to April 5th of the following year.

- Tax rates and thresholds change annually, so it’s essential to stay updated on the latest information.

- Individuals are responsible for reporting their income and paying their taxes through the Self Assessment system.

Capital Gains Tax, Personal finance uk

Capital Gains Tax (CGT) is levied on profits made from the disposal of assets, such as property, shares, and bonds.

- The current CGT rate for most assets is 18% for basic rate taxpayers and 28% for higher rate taxpayers.

- Individuals have an annual Capital Gains Tax allowance, which is the amount of profit they can make tax-free each year.

- There are exemptions for certain assets, such as your primary residence, and for certain types of investments, such as shares held within an ISA.

Inheritance Tax

Inheritance Tax (IHT) is levied on the value of an individual’s estate when they pass away.

- The current IHT threshold is £325,000, meaning that any assets above this value are subject to a 40% tax rate.

- There are various exemptions and reliefs available, such as the residence nil-rate band, which can reduce the amount of IHT payable.

- Effective estate planning can significantly minimize the amount of IHT payable.

Financial Planning

Financial planning involves setting financial goals, creating strategies to achieve those goals, and managing your finances effectively. It encompasses various aspects, including:

- Retirement planning: This involves saving and investing for your future retirement years.

- Estate planning: This involves planning for the distribution of your assets after your death.

- Investment planning: This involves making strategic investment decisions to achieve your financial goals.

- Debt management: This involves managing your debt effectively to avoid financial distress.

Tax Efficiency

Tax efficiency involves minimizing your tax liabilities while maximizing your after-tax income.

- Utilize tax-efficient savings and investment schemes, such as ISAs and pensions.

- Claim all eligible tax deductions and reliefs.

- Consider tax-efficient investment strategies, such as investing in dividend-paying shares.

- Consult with a qualified financial advisor for personalized advice.

Digital Tools and Resources

The digital age has revolutionized how we manage our finances. Numerous online tools and resources are available to help you budget, invest, and plan for your financial future. These tools can streamline your financial management, offering valuable insights and features to make informed decisions.

Popular Online Resources and Tools

Online tools and resources have become indispensable for managing personal finances in the UK. Here are some popular options:

- Budgeting Apps: These apps help you track your income and expenses, set budgets, and identify areas where you can save money. Some popular budgeting apps in the UK include:

- Monzo: This app allows you to track spending, set budgets, and even round up purchases to invest in a savings account.

- Yolt: This app aggregates your accounts from various banks and financial institutions, providing a comprehensive overview of your finances.

- Moneybox: This app offers a range of financial products, including a budgeting tool, savings accounts, and investment options.

- Investment Platforms: These platforms allow you to invest in a range of assets, including stocks, bonds, and ETFs. Some popular investment platforms in the UK include:

- Hargreaves Lansdown: This platform offers a wide selection of investment products, including ISAs, SIPPs, and funds.

- AJ Bell: This platform provides a user-friendly interface and access to a range of investment options.

- Fidelity: This platform offers a range of investment services, including investment accounts, ISAs, and SIPPs.

- Financial Calculators: These calculators can help you make informed financial decisions by providing estimates for things like mortgage payments, retirement savings, and loan repayments. Some popular financial calculators include:

- MoneySavingExpert: This website offers a wide range of financial calculators, including mortgage calculators, loan calculators, and retirement calculators.

- The Money Edit: This website provides a variety of financial calculators, including a savings calculator, an investment calculator, and a debt calculator.

- Which? Money: This website offers a range of financial calculators, including a mortgage calculator, a loan calculator, and a credit card calculator.

Utilizing Digital Tools Effectively

To effectively utilize digital tools for personal finance management, follow these tips:

- Choose the right tools: Select tools that align with your financial goals and needs. Consider factors such as ease of use, features, and cost.

- Set up automatic tracking: Enable automatic expense tracking features to minimize manual data entry and ensure accuracy.

- Regularly review your finances: Review your spending patterns, investment performance, and financial goals periodically to make adjustments as needed.

- Set realistic goals: Establish achievable financial goals and use the tools to track your progress.

- Seek professional advice: Consult a financial advisor for personalized guidance, especially for complex financial matters like investment strategies or retirement planning.

Benefits and Drawbacks of Using Digital Tools

Digital tools offer numerous benefits for managing personal finances, but it’s important to be aware of potential drawbacks:

- Benefits:

- Convenience: Access your finances anytime, anywhere.

- Real-time insights: Track your spending and investments in real-time.

- Improved budgeting: Easily create and manage budgets.

- Increased savings: Identify areas where you can save money.

- Automated features: Set up automatic payments, transfers, and investments.

- Drawbacks:

- Security risks: Ensure you use reputable platforms and follow security best practices.

- Over-reliance: Don’t solely rely on digital tools; develop sound financial habits.

- Data privacy concerns: Understand how your data is collected and used.

- Technical issues: Be prepared for occasional technical glitches or outages.

- Potential for distractions: Avoid using digital tools as a means to procrastinate on financial responsibilities.