Best personal and small business finance software can be a game-changer for individuals and businesses seeking to manage their finances effectively. Whether you’re trying to achieve personal financial goals, like saving for retirement or paying off debt, or looking to streamline your small business operations, the right software can provide invaluable tools and insights.

From budgeting and expense tracking to invoicing, payroll, and reporting, finance software empowers users with a comprehensive suite of features to optimize their financial well-being. By automating tasks, providing real-time data, and offering actionable insights, these tools help individuals and businesses gain greater control over their finances and make informed decisions.

Key Features of Small Business Finance Software

Small business finance software offers a comprehensive suite of tools designed to streamline financial operations and provide valuable insights for informed decision-making. These applications encompass essential features that cater to various aspects of financial management, enabling businesses to optimize their processes and enhance their overall financial health.

Accounting

Accounting is the backbone of any business, and small business finance software provides a robust platform for managing financial records effectively. These solutions offer features such as:

- General Ledger: The general ledger serves as the central repository for all financial transactions, providing a complete overview of the business’s financial position.

- Chart of Accounts: A well-defined chart of accounts is crucial for accurate financial reporting. Small business finance software allows users to create and customize a chart of accounts that aligns with their specific business needs.

- Bank Reconciliation: Reconciling bank statements with the business’s internal records is essential for ensuring accuracy and identifying discrepancies. Software solutions automate this process, saving time and reducing errors.

- Financial Reporting: Generating comprehensive financial reports, such as balance sheets, income statements, and cash flow statements, is essential for understanding the business’s financial performance. Small business finance software provides pre-built report templates and customization options to meet specific reporting requirements.

Invoicing, Best personal and small business finance software

Effective invoicing is crucial for timely payments and maintaining healthy cash flow. Small business finance software streamlines the invoicing process, providing features such as:

- Invoice Creation and Management: Software solutions allow businesses to create professional-looking invoices with customizable templates, including company logos, contact information, and payment terms.

- Automated Reminders: Automated reminders help ensure that invoices are paid on time, reducing the risk of late payments and improving cash flow.

- Online Payment Integration: Integrating online payment gateways allows customers to make payments directly through the invoice, further simplifying the process and accelerating payment collection.

- Invoice Tracking: Software solutions provide real-time tracking of invoice status, allowing businesses to monitor outstanding invoices and identify potential payment delays.

Payroll

Managing payroll efficiently is critical for maintaining employee satisfaction and compliance with labor laws. Small business finance software offers comprehensive payroll features, including:

- Employee Data Management: Software solutions provide a secure platform for storing employee information, including personal details, tax information, and payroll deductions.

- Time and Attendance Tracking: Integrating time and attendance tracking systems ensures accurate payroll calculations based on actual hours worked.

- Payroll Calculations and Processing: Small business finance software automates payroll calculations, ensuring accurate deductions for taxes, benefits, and other withholdings.

- Direct Deposit and Check Printing: Software solutions allow for seamless direct deposit of paychecks or printing of physical checks, providing flexibility for employee payment options.

- Payroll Reporting: Generating payroll reports, including pay stubs, tax summaries, and year-end reports, is essential for compliance and record-keeping purposes.

Inventory Management

For businesses that handle inventory, efficient inventory management is crucial for maintaining optimal stock levels and minimizing costs. Small business finance software provides features that streamline inventory management, including:

- Inventory Tracking: Software solutions allow businesses to track inventory levels in real time, providing visibility into stock availability and identifying potential shortages.

- Purchase Order Management: Managing purchase orders effectively ensures timely procurement of inventory and minimizes delays in production or service delivery.

- Stock Forecasting: Software solutions can analyze historical sales data and other factors to predict future inventory needs, enabling businesses to optimize stock levels and minimize waste.

- Inventory Valuation: Accurately valuing inventory is essential for financial reporting and tax purposes. Software solutions provide methods for calculating inventory value based on different valuation methods, such as FIFO or LIFO.

Reporting

Generating insightful reports is crucial for making informed business decisions. Small business finance software provides comprehensive reporting features, such as:

- Financial Statements: Software solutions generate standard financial statements, including balance sheets, income statements, and cash flow statements, providing a clear picture of the business’s financial health.

- Customizable Reports: Businesses can create custom reports tailored to their specific needs, allowing them to analyze data from different perspectives and gain valuable insights.

- Dashboards and Key Performance Indicators (KPIs): Software solutions often provide dashboards that display key performance indicators, providing a quick overview of the business’s financial performance and identifying areas that require attention.

- Trend Analysis: Analyzing financial data over time can reveal trends and patterns, enabling businesses to identify growth opportunities or potential risks.

Comparison of Popular Small Business Finance Software Solutions

| Feature | Xero | QuickBooks Online | FreshBooks | Zoho Books |

|---|---|---|---|---|

| Accounting | ✔ | ✔ | ✔ | ✔ |

| Invoicing | ✔ | ✔ | ✔ | ✔ |

| Payroll | ✔ | ✔ | ✔ | ✔ |

| Inventory Management | ✔ | ✔ | ✔ | ✔ |

| Reporting | ✔ | ✔ | ✔ | ✔ |

| Mobile Access | ✔ | ✔ | ✔ | ✔ |

| Customer Support | ✔ | ✔ | ✔ | ✔ |

| Integrations | ✔ | ✔ | ✔ | ✔ |

| Pricing | Starts at $30/month | Starts at $25/month | Starts at $15/month | Starts at $12/month |

Popular Personal Finance Software Solutions

Personal finance software can be a valuable tool for individuals looking to manage their finances effectively. These software solutions offer a range of features designed to help users track their income and expenses, create budgets, set financial goals, and analyze their spending patterns. Popular personal finance software options include Mint, Personal Capital, and YNAB (You Need A Budget). Each platform offers unique features, pricing structures, and target audiences.

Key Features, Pros, and Cons of Popular Personal Finance Software Solutions

Here is a comparison of three popular personal finance software solutions based on their key features, pros, and cons:

| Feature | Mint | Personal Capital | YNAB (You Need A Budget) |

|---|---|---|---|

| Pricing | Free | Free (with premium features available) | $14.99/month or $84/year |

| Budgeting | Yes, with automated budgeting features | Yes, with advanced budgeting tools | Focuses on zero-based budgeting and goal-oriented planning |

| Financial Tracking | Tracks income, expenses, and net worth | Tracks income, expenses, investments, and net worth | Tracks income, expenses, and spending categories |

| Investment Tracking | Limited investment tracking | Extensive investment tracking and analysis | No investment tracking |

| Debt Management | Provides debt payoff tools and insights | Provides debt payoff tools and insights | Focuses on managing debt through budgeting and goal-setting |

| Goal Setting | Allows users to set financial goals | Allows users to set financial goals and track progress | Strongly emphasizes goal-setting and budgeting for achieving goals |

| Reporting and Analytics | Provides basic reports and insights | Provides comprehensive reports and analysis, including investment performance | Provides reports and insights focused on budgeting and spending patterns |

| Mobile App | Available on iOS and Android | Available on iOS and Android | Available on iOS and Android |

| Pros | Free, easy to use, automated features | Comprehensive financial tracking, investment analysis, free version | Effective budgeting methodology, goal-oriented approach |

| Cons | Limited features, some users find it less accurate, less control over budgeting | Premium features require a subscription, some users find it overwhelming | Subscription required, requires a commitment to the budgeting method |

Popular Small Business Finance Software Solutions

Choosing the right small business finance software can significantly streamline your operations and improve your financial management. Several excellent options are available, each with unique features and benefits. This section will delve into some of the most popular choices, comparing their key features, pricing, and target audience.

Popular Small Business Finance Software Options

| Software | Key Features | Pros | Cons |

|---|---|---|---|

| QuickBooks Online |

|

|

|

| Xero |

|

|

|

| FreshBooks |

|

|

|

Tips for Using Finance Software Effectively: Best Personal And Small Business Finance Software

Finance software is a powerful tool for managing your personal or business finances, but it’s only as effective as you make it. To get the most out of your chosen software, it’s crucial to use it strategically and consistently. This involves setting it up properly, customizing it to meet your unique needs, and actively engaging with its features to track progress towards your financial goals.

Setting Up and Customizing Finance Software

Setting up and customizing your finance software correctly is the foundation for successful usage. It ensures the software accurately reflects your financial situation and helps you track the right data.

- Start with a Clean Slate: Before you start inputting data, take the time to create a clear and organized structure. This includes setting up accounts, categories, and budgets. This will make your data easier to analyze and understand.

- Categorize Expenses: Create detailed categories for your expenses. This allows you to identify areas where you might be overspending and make informed decisions about your spending habits. For example, instead of just having a ‘Food’ category, create subcategories like ‘Groceries,’ ‘Dining Out,’ and ‘Coffee.’

- Set Realistic Budgets: Create a budget that reflects your actual income and expenses. You can use the software’s budgeting tools to track your spending against your budget. This will help you stay on track and avoid overspending.

- Automate Transactions: Connect your bank accounts to the software to automate transaction imports. This saves you time and reduces the risk of errors in manual data entry.

- Customize Reports: Explore the software’s reporting features and customize them to provide insights into your financial situation. You can create reports that show your income and expenses by category, track your net worth, or analyze your investment performance.

Tracking Progress Towards Financial Goals

Finance software is a valuable tool for monitoring progress towards your financial goals. By actively engaging with the software’s features, you can stay on track and make informed decisions about your finances.

- Define Your Goals: Clearly define your financial goals, whether it’s saving for retirement, paying off debt, or buying a house. The software can help you track progress towards these goals.

- Set Milestones: Break down your goals into smaller, achievable milestones. This will help you stay motivated and track your progress.

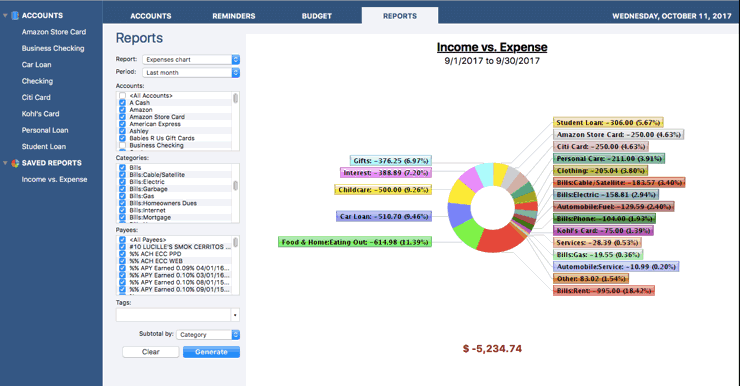

- Use Visualizations: Use the software’s charts and graphs to visualize your financial data. This can help you identify trends and make informed decisions. For example, a pie chart showing your spending by category can help you see where your money is going.

- Review Regularly: Review your finances regularly, at least monthly. This will help you stay on top of your spending, track your progress towards your goals, and make necessary adjustments to your budget.

Future Trends in Finance Software

The world of personal and small business finance software is constantly evolving, driven by advancements in technology and changing user needs. Emerging trends are reshaping how we manage our finances, offering greater automation, personalized insights, and seamless integration with other financial services.

Impact of Emerging Trends on Financial Management

These trends are poised to revolutionize financial management, making it more efficient, accessible, and data-driven. AI-powered financial planning will help users make informed decisions based on their unique financial goals and risk tolerance. Mobile-first solutions will enable users to manage their finances on the go, while seamless integration with other financial services will create a more connected and streamlined financial ecosystem.

Key Trends and Benefits

| Trend | Benefits |

|---|---|

| AI-Powered Financial Planning |

|

| Mobile-First Solutions |

|

| Integration with Other Financial Services |

|

| Open Banking and Data Sharing |

|